“On the other hand, when you look at a group of properties, you can start to extrapolate demand vertically (on the tape chart). If you look at individual units, you can only extrapolate demand horizontally (on the tape chart): however, that doesn’t always work because the fact that a unit was booked last week doesn’t necessarily mean that it’s going to be booked next week.”

“It’s very difficult to revenue manage any volume of units individually.

DIFFERENCE BETWEEN BOOKINGS AND REVENUE HOW TO

“One of the most important things about being able to use pickup-based revenue management practices is that you have to learn how to group your properties together based on similarities,” says John. Portfolio organisation: How to group your properties together On the other hand, more far-out dates that are pacing higher (shown by the larger green portions of the bar) than you’d expect may present an opportunity to raise your rates and capture a higher ADR.Īt the end of the day, you will have to set your own guidelines for what pace is high or low, and where you are comfortable seeing your occupancy at any given time – but that is a conversation for another article! Here’s another example using a different portfolio:Īs you can see, near-future dates with low occupancy and low pace (where you’ve made limited recent sales) may present an opportunity to lower your rates and capture demand. Once you know this, you can set a reminder for yourself to check back on those dates later and if they don’t sell, pull the rates back down. If they don’t continue to sell, you can make a decision: should you lower your rates back down or leave them up and see if they do sell eventually?” he adds. If they continue to sell, you can continue to push your rates up. “Then, you can look at how those dates are selling week-over-week. Because those dates are not only starting to get more occupancy earlier than you’d expect, but it’s also happening recently,” John says. “For example, if you see a date range in the future that’s getting booked unusually early, you might be able to raise your rates for those dates. The combination of this data allows you to make informed revenue management decisions. CLICK TO ENLARGEīy looking at your booked nights, you can instantly tell where the occupancy gaps are.Īnd when you consider the time periods on the X-axis, you can see at a glance how your sales were pacing in the last 14, 7 or 3 days. Total number of nights booked in the last 3 days for future dates (daily breakdown). Total number of nights booked in the last 7 days for future dates (daily breakdown). Total number of nights booked in the last 14 days for future dates (daily breakdown). “When you bring it down to a daily level, you can start to get an idea of where all your money is and where you’re not making sales – which is the most important thing for a revenue manager,” says John. To be able to use this data to make pricing decisions, you need to look at specific dates in the future. How can you use pickup to take actionable revenue management decisions? In the last 14 days, they sold 34 of those 448 nights.īut how does all this help you make better revenue management decisions? Let’s take a look.

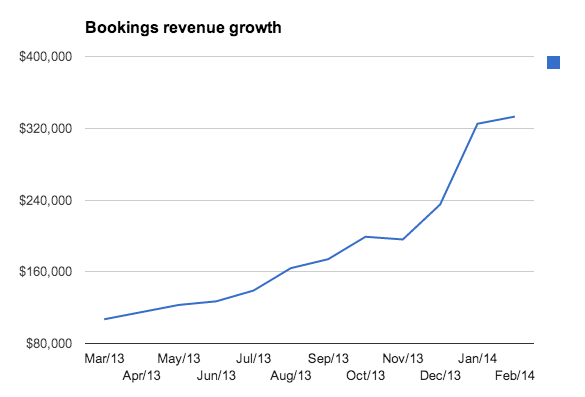

Sticking to the example above, this portfolio has 448 nights on the books for September. “You try to understand, in a certain time period, how much revenue or how many nights you have sold for all your future time periods,” says John.įor example, you can ask yourself: “How much did I pick up in the last 14 days?” booking pace) to your total revenue or booked nights. The concept of pickup is when you start applying booking velocity (i.e. Instead of total revenue, some revenue managers like John prefer to look at booked nights.īooked nights – a surrogate for occupancy – may be a better metric to use than revenue when you’re grouping together properties that are similar but not the same (we’ll talk about how to group your properties later.) Total number of nights booked in the last 14 days for future dates (monthly breakdown). While your booked-on sales may be pacing similarly to last year’s, your stayed-on revenue could be pacing behind – which means you need to make revenue management decisions urgently.Įxample of similar booked-on pace but differences in stayed-on pace. Knowing the difference between booked-on sales and stayed-on revenue is crucial to maximising your revenue. Or, if you were looking at it in hindsight, you could say ‘I made $75,000 in September.’” “So you could say: ‘I expect to make $75,000 in September’. “This money is actualising in September,” John says. So, in this particular portfolio, there is nearly $75,000 booked for September.

In this graph, each bar shows how much revenue has been sold for the periods on the X-axis. Booked-on sales vs stayed-on revenue Total revenue booked in the last 14 days for future dates (monthly breakdown).

0 kommentar(er)

0 kommentar(er)